It’s interesting the emotions and feelings you remember.

I remember the feeling, stunned at first, mouth agape watching the news looking for some sort of clue as to what it meant. Then furiously texting everyone in the team trying to figure out what next - job? No job? That feeling of utter panic with the realisation that this was really it and the unknown of what tomorrow would bring.

|

| Plaque on wall of 25 Bank Street during Lehman's time there |

It wasn’t supposed to be that way. We all knew that things weren’t great at the firm. Bear Sterns had disappeared 6 months earlier, bought by JP Morgan backed by the US Fed. FannieMae and FreddyMac, giant US mortgage institutions, had needed to be rescued just the previous month, backstopped by massive US government intervention. We knew we were next in line, the rumours had been brewing since Bear went under - Lehman was under capitalised, over leveraged, over exposed to toxic credit products, the newspapers told us. The write downs had been severe over the previous few quarters and there was a sense of foreboding brewing internally as the share price declined rapidly with each day.

But we were Lehman Brothers, we had the Lehman spirit and bled Lehman green. We got up every morning and gave our all for that company. No matter the hours, no matter the time, no matter the work. We came in every day and battled like our lives depended on it. That ship wasn’t going to go down on our watch. The firm had been through rough times before and survived, no one was going to drag us down this time.

There were emails for the green spirit - Joe Gregory COO famously sent one when the rumours and the vultures first started swirling around:

“Rumour: Lehman is dangerously exposed to Icelandic Banks

FACT: Lehman has very limited exposure to Icelandic banks

Rumour: Lehman is undercapitalised and is at severe risk of not meeting its obligations

FACT: Lehman has to plenty of capital to meet its needs

Rumour: Lehman required emergency access to the Feds overnight Funding facility

FACT: Lehman required no emergency overnight funding and is perfectly able to fund its activities through normal means”

...and so it went on.

“Rumour: Lehman is dangerously exposed to Icelandic Banks

FACT: Lehman has very limited exposure to Icelandic banks

Rumour: Lehman is undercapitalised and is at severe risk of not meeting its obligations

FACT: Lehman has to plenty of capital to meet its needs

Rumour: Lehman required emergency access to the Feds overnight Funding facility

FACT: Lehman required no emergency overnight funding and is perfectly able to fund its activities through normal means”

...and so it went on.

There were statements and video messages for the green soul. The CEO and charismatic head of the company Dick Fuld sending internal video messages spreading the message that we would survive, we were better than them all and that they’ve tried to bring us down before and failed then and they’ll fail now.

We loved it, we bought it and we took it to heart as our own rallying cry. ‘The banking world was against Lehman but we had what it takes to better them all’.

The place was like a family. You fought for each other and you fought with each other. Working deep into the night to make sure it all ticked, whilst simultaneously screaming and swearing across the floor at each other in a rage. There was slamming of phones, screaming down phones, traders smashing screens and pens and other objects thrown in anger at people.

We were in the trenches, it felt like a war zone, but we absolutely lived it. Grafting hard and playing even harder. Each night packing it in, sometimes 9, sometimes 10, many times later then at least a couple times a week across the river to smolenskis or the slug & lettuce - the drinks flowing and the rows forgotten, or relived in animated format. Then back in the next day to do it all again.

I’ve not met a person I worked with at Lehman who didn’t love the place and the way it worked, it had an aura and a feeling to it not matched. Even in the anger and the monotony of some of the daily work you’d still bleed green for each other.

The xmas party of 2006 will live long in the memory. Held in Old Billingsgate Market after the firm had just announced record profits of $4bn for the year (small for now but large back then), the troubles to come a distant dream. As you walked in the champagne was piled high to the ceiling, glass on glass. Electric violinists played a concert live to those of the 4,000 European employees present, while bumper cars and other amusements were in access in other rooms. It was a time for celebration, it was extravagant, it was boozy but the firm felt untouchable with only one direction to keep on going in. It was a party the likes of which I’d not been to before and not been to since.

The good times were great, but it couldn’t last and it all came crashing down. There were feelings post March 2008 inside the bank that things weren’t so rosey. There were the right downs, the restructurings, the start of the first layoffs since I’d been there (I joined in 2004). But everyone took the news, from the outside and the inside, as if it was a personal affront on ourselves. As the share price went on its long decline the vultures began to circle and it got to the point as to whether we weren’t going to get through the storm without some assistance.

The hedge fund shorts were circling and a siege mentality set in, but we never believed it would crash completely. There were moves to shore things up, rumours of what was required to put some stabilisation in - maybe sell the asset management arm NeubergerBermann to raise funds, sell large property holdings, there was even a large rumour that a Korean bank was about to buy a 10% stake to shore us up.

|

| Front Page of the Times on Thursday 18th September |

But as it got to the afternoon of Friday 12th September 2008 it was beginning to loom that the firm may not survive, at least without some help. We were going to go the Bear Sterns route. As the head of Ops gathered us all on the 6th Floor of 25 Bank Street, a scene that was happening in the meeting rooms and trading floors across the building, the message was gloomy. We were told that we were looking for a buyer to help us out and that there were 2 firms interested - Barclays & Bank of America -, that we were negotiating with both and that by the end of the weekend our future would be sorted, but with no knowledge of what that would mean in each of our own departments. Some people would be asked to come in at the weekend to assist with providing any information that was required by the suitors.

Those of us that went home that Friday night did so with a sense of gloom and uncertainty that the Lehman dream as it was would soon be over, but a feeling of optimism that the Fed would deliver, as it had with Bear Sterns, and assist our transition with BoA or Barclays. As the weekend rolled on and the uncertainty grew, news broke on Sunday afternoon that BoA had bought MerrillLynch, the 3rd largest Investment Bank. A sense of shock hit me but at least it was now apparent that the path was clear, Barclays would be our suitors.

But then that 10pm news bulletin and that sense of betrayal. They had let us go. BoA had saved Merrills and Barclays and the Fed had chosen to watch us die. Everyone else had been bailed out until now (and would be after). Maybe the Gorilla (Dick Fuld’s nickname) had been right all along and they really did just want to see us fail. In the long term it was in some parts understandable the decision they took to let Lehman fail, but back then as an employee it felt like pure revenge on their part. Why save everyone else and leave us to the scrap heap?

So the text went out to a colleague

- “what does this mean? Job? No Job?”.

- “No job, I think” came the reply

- “F@&£!!!!” was my simple response

- “what does this mean? Job? No Job?”.

- “No job, I think” came the reply

- “F@&£!!!!” was my simple response

The next few hours and the night ahead were restless and sleepless. Travelling in on the tube the next day was a nervy experience. I didn’t even know if we’d be let in the building. Whereas previously there was pride in revealing that Lehman brothers pass, now only fear & shame. I arrived at the European Headquarters that morning of 15th Sept greeted by a multitude of press outside. As we went in we were all handed a sheet of paper from the administrators PWC telling us they had taken over the day to day running of the European operations and for us not to contact any clients or carry out any business.

When we got upstairs to our desks it was chaotic. Logging into the system, seeing dozens of emails from friends & family asking me what was happening and if all was ok.....until they blocked all emails going in and out. Some people within didn’t even realise what had happened, carrying out their daily morning tasks firing off emails for action before heading to the gym! It was a couple of hours before anyone in the know spoke to us.

|

| Newspaper Headlines on the day after the collapse |

A conference call organised by the head of Ops for all operations staff. As people started dialling in, the line got jammed as too many people, those invited and those just desperate for info, pushed the conference number over the 50 person limit. We were told to head up to Floor 11 instead, where the address would be made in person. Heading up from floor 3 suddenly became impossible as the lifts got clogged by 100s trying to get upstairs to find out what would be. The stairs was the only option and as we emerged to the packed floor, there was the global head of Ops standing atop of the desks shouting at the top of his voice so all could hear.

There was complete uncertainty in all we were told. The firm was bankrupt, the London arm had been left to fend for itself and there was uncertainty if anyone would get paid for work done that month. Given it was the 15th and payday was the 21st there was almost a riot. “How am I supposed to pay my mortgage!” screamed one person. There were no answers just a growing uncertainty.

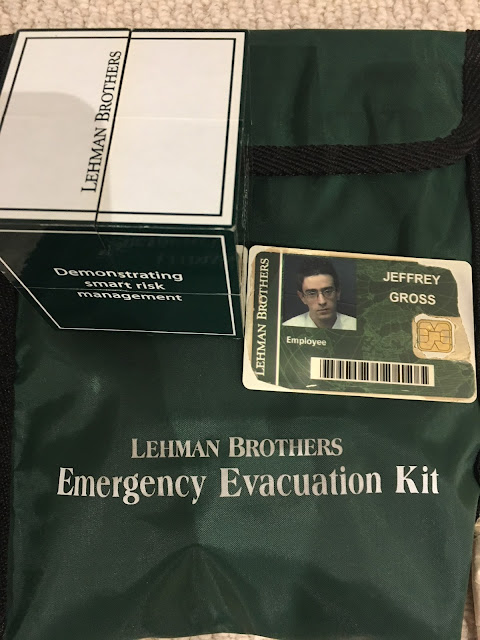

Meanwhile a mob rule was breaking out across the whole building. Previously measured people were scouring the floors and the cupboards for any memorabilia they could find, or maybe sell later just to have something. People took their emergency evacuation kits stamped with the Lehman logo from under their desks to take for memories. Some people started raiding the canteen, taking whatever they could like boxes of bananas - they were owed by the firm, they felt, if they weren’t getting paid, then they’d take the payment in whatever form they could. Mayhem and chaos!

But still the brotherhood in arms was apparent. As soon as the pubs opened at 12 people starting piling down the slug and lettuce to begin drowning their sorrows. Some drank more and quicker than others, deciding the bottom of the bottle was the only way to go. I slipped away after a couple of hours, deciding this wasn’t the way I was gonna go, but others stayed on deep into the night. Some even got free accommodation in hotels locally that night when they proclaimed their status as former Lehman employees. Volatile in its life, just as volatile in its death.

Over the next few days and weeks we had to continue to come in to work, just so the administrators knew we hadn’t gone elsewhere and eventually they found enough money to ensure everyone got paid for the next 2 months. Those days were surreal as we turned up to do nothing productive. Spending the days sat at desks playing computer games (even the MDs!) and reliving past great moments. 3 hour liquid lunches were the norm as we fulfilled the request to turn up to ensure we got our pay check.

Eventually about a month later in mid October the Japanese bank Nomura came forward to take on the Europe and Asian employees and infrastructure of the firm. An element of safety had been restored but it would never be the same.

I understand the global financial crisis impacted a lot of people in a very negative way and the collapse of Lehman played a big part in that. All employees were a cog in that wheel but most of us weren’t culpable. A lot of us were lucky and got to continue in employment where others impacted didn’t. But many also lost a lot, their futures heavily invested in the firm tying their pension and current wealth in the firms shares and ultimately losing it all. (Lehman had the largest employee ownership of all large Wall Street firms at 33%!). But this isn’t about that.

Lehman was a family, a firm that encouraged you to give everything but that you felt you wanted to give everything for. Friendships bonded there still stand strong.

And ask most ex Lehman employees about how they feel about the firm and I’m sure they’ll tell you:

“I still bleed green”!

|

| My Lehman Pass and some Memorabilia I picked up in the mayhem! |

Shocking. Well written. Thanks for the inside view Jeff.

ReplyDeletetouching and well written, great job Jeff.

ReplyDelete