'So Far, so good. So far, so good. So far, so good'.

How you fall doesn't matter, it's how you land." (Hubert, La Haine (1995))

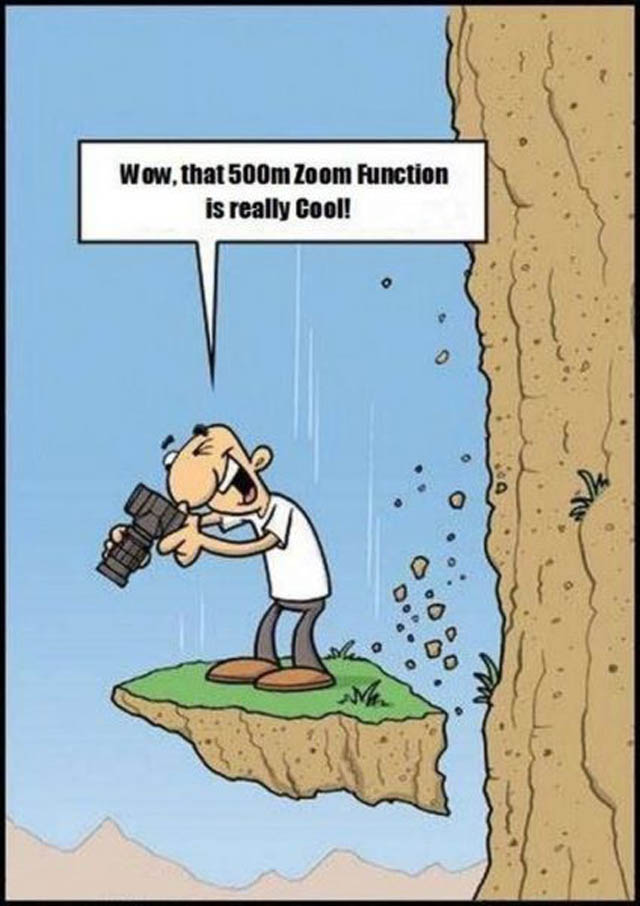

The opening lines from the excellent French film La Haine are said by another character, Vince, to describe society in free fall. Whatever metaphor the director was trying to demonstrate, for me the man falling resembles market reaction and some political attitude to the impending hitting of the US debt ceiling.

October 17th is the date given by the US Treasury that the US will hit the limit of it's borrowing unless Congress approves an increase in the debt ceiling. But with no compromise forthcoming that scary possibility is beginning to increase in likelihood. Yet despite this impending potential default on US debt, market reaction has been relatively muted compared to what you might expect with the risks attached to such a scenario for the worlds largest economy and so called safest asset.

The S&P 500 is only down 1.8% since September 27th and sits just 3.7% below the record high of 1,725 reached on September 18th. 10 and 5 Year Treasury yields have actually fallen over the last couple of weeks by 4 and 6% respectively to 2.65% and 1.41%. The 3 month t-bills have seen their yields spike by 400%, but this is to a yield of just 0.05%, hardly the sort of yield you'd expect to see charged to a country potentially 9 days away from default. This is the same market which back in June pushed the S&P down 4.8% in a week, and pushed 5yr and 10yr yields up 41bps and 35bps respectively just on the hint of QE being reduced. Meanwhile the current 5-year US Sovereign CDS spread (effectively the cost for an investor to insure against US default on the 5-year bond) sits only at a cost of 35.5bps, slightly above that of the UK. We're falling down the building, but 'so far, so good'. Perhaps the first sign of real panic was seen yesterday in the 1 month t-bill yield which doubled to 0.27% from the previous day, having been only 0.01% on 20th September, perhaps investors seeing the impending floor below, but again not the sort of premium one would demand on an asset potentially close to default.

The truth is the attitude of 'so far so good' from the markets, and from certain Republicans who view that hitting the debt ceiling is no big deal itself, could be seen from the point of view that they think they're looking at the boy who cried wolf. After all, we've been here before. In July/August 2011 a similar crisis ensued only to be averted at the last minute through negotiations between Obama and Republicans, while at the end 2012 hitting the debt ceiling was avoided through the budget sequestration enforcing fiscal cuts. Back in 2011 the market only fell through the floor in the last week with S&P 500 dropping 9.9% in the last 8 days of the crisis, but even then, the 1 month bill peaked at a yield of only 0.16% and investors actually bought more long-term treasury bonds as "safe assets". It is perhaps this failure of the markets to panic which is encouraging Republicans from not backing down from their stance, even while the President and Treasury Secretary correctly indicate that a default on US debts would be catastrophic for both the US and world economies. After all, if the market "professionals" aren't really panicking then surely it's no big deal?

Part of the issue is no one is quite sure what will happen if the debt ceiling is reached. The US is unique among sovereigns in that there is apparently no joint default clause in their bond issuances. This would mean should the US fail to pay investors on bonds maturing at the end of October, they would not be declared in technical default of their other bonds. Meanwhile having been close to this point before in 2011, the Treasury could have methods up it's sleeve to ensure any sovereign default is delayed for as long as possible by prioritising payments (as Republicans seem to think). After all, in most organisations, when you come close to disaster, and that disaster could occur again, you then should ensure you have a plan in place to mitigate that event in future, as best you can. Payments could, for example, be made to the bond holders first with delays on social welfare payments, so at least in the eyes of investors and the ratings agencies then the US is still good for it's borrowings. An interesting article from FT Alphaville however indicates that the Treasury may not necessarily find it so easy with their infrastructure to do this prioritisation. The Treasury of course isn't going to reveal it's plan in public, especially from a political perspective, to give the Republicans any more reason to believe it is not a big deal so they can continue to hold out. There are also suggestions the Fed could intervene, as it was specifically designed to prevent financial crises and has powers under an 'exigent circumstances clause' to do whatever is in it's power monetarily to prevent disaster. This could include buying existing bonds from the treasury for funding purposes. All of this however is pure speculation and it should really make us worry that we're here, again.

The reality is, that even if any of the above measures delayed the US from default for the few days extra needed to reach agreement the damage caused would be hard to reverse, if it could be reversed at all. Goldman Sachs estimate that a failure to raise the debt ceiling and the resulting fiscal pullback could reduce annual GDP in the US by 4.2%. To put that in perspective the US is currently only growing at a year on year growth of 1.6% in the last quarter. Even if the US prioritised making payments to bondholders as opposed to other expenses as suggested, whilst it would not put it in sovereign default, it's inability to make payments to those it owes would severely damage it's credibility. As with any business that fails to make payments on time, it would make all it's creditors less trusting to lend to it in future for fear that they would be next. The interest rate demanded of the US treasury, already on an upward trend over fears of tapering, would be pushed up even further as investors would demand a higher risk premium for holding an asset seemingly constantly on the brink of default. The credit rating agencies of Fitch and Moody's who have yet to downgrade the US, would also most likely reassess and could follow their peers at S&P in imposing a ratings downgrade. Further downgrades could force many organisations such as money market funds to dispose of their treasury holdings as they are obliged to hold higher quality assets, whilst the use of these assets for collateral on derivative contracts may also have to be reduced. This forced sale of treasuries would push the price down and yields up, further increasing not only the cost for the US to borrow, but also having a knock on affect on borrowing costs for everyone wishing to borrow in US dollars. The view of the US dollar as the reserve currency and US Treasury Bonds as the risk free asset could ultimately be called into question. To paraphrase Hubert, it's not the fall that matters, it's the landing that counts.

All of this says, that putting such an important economic matter as the ability to increase a country's debt, into the hands of those who seemingly have no real grasp of basic economics and it's consequences, is, as Warren Buffet suggested, akin to threatening to set off a nuclear bomb on themselves. We wouldn't do that, so we shouldn't use the debt ceiling the same way. Not that Obama can claim the moral high ground here. There is no better example of the pure politicising of this tool than from the words of Obama himself as a senator back in January 2006 opposing the debt ceiling increase then:

“The fact that we are here today to debate raising America’s debt limit is a sign of leadership failure. It is a sign that the U.S. government can’t pay its own bills. ... I therefore intend to oppose the effort to increase America’s debt limit.”

Obama now obviously says he regrets that action as a naive new Senator, but it is an example of why many naive Congressman shouldn't have such a power. We shouldn't have to wait for them to get into the Oval Office or their party into power to realise that this is not something which should be used and abused for political gain. Compromise needs to be reached and fast and then this pointless tool should be taken away from the irresponsible.

But instead both sides wait, neither wanting to flinch. It reminds me of that superb advert for Guinness back in the 1990's of the surfer waiting for the perfect wave and the words quoted out of Moby Dick. The tagline for Guinness of course is 'Good Things Come To Those Who Wait'. Not however when you're falling from a 50 story building. Markets are very soon going to realise that we're about to hit that floor as they look down. If we do hit the floor it's going to impact us all, possibly in a way far worse than the recession we're just crawling out of. Waiting is not an option, its time to pull the parachute chords. How you fall doesn't matter, it's how you land.

No comments:

Post a Comment