|

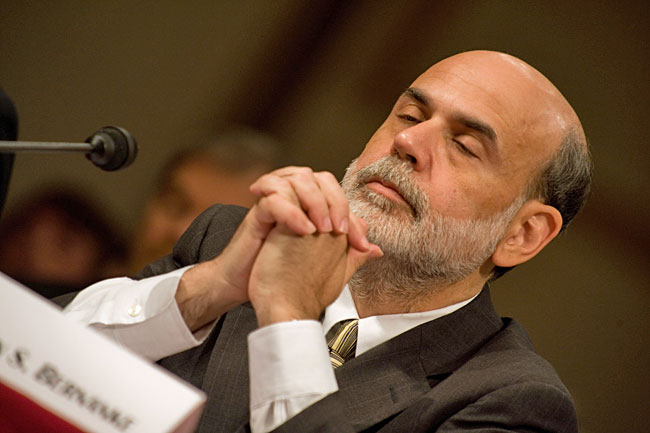

| Bernanke Praying for the markets and media to just understand what he's saying! |

A few weeks later Bernanke followed this up in a Q&A session on July 10th. He reiterated that interest rates were not going to rise in the immediate future until unemployment was below 6.5%, inflation was under control around the target level, and even then only if the economy itself was showing sustainable signs. But he also said that there was a mix of instruments involved, and that asset-purchases (QE) was the other component than interest rates, indicating as he did the previous month that this is what would be reduced first. However, what he also stated was that, "highly accommodative monetary policy for the foreseeable future is what’s needed in the U.S. economy". This was, according to the media and markets reversing track on what he had said in June and encouraging the stock market at least to hit the same levels as June 18th.

Then over the last couple of days while giving his semiannual statement to congress he mentioned that there was no "preset course" for ending QE and that any change would depend on how the economy was doing, stating "What we’re looking for is a pick-up as the year progresses. We’re going to look at the data. It’s a committee decision. It’s going to depend on whether we see the improvement which I described.” This time, finally, the market (and media) translated this as him actually saying they won't take action until the economy is strong enough to support it, with the S&P 500 hitting a new record high of 1,693.

So just to clear it all up in case you weren't listening........

June 19th: Bernanke tells us all that should things improve to the targets as projected they'll ease off QE but only if things do indeed get better and there is no set policy. Market Drops and analysts and media throw a tantrum.

July 10th: Bernanke states there are targets to get to. Not to assume it will happen or assume there is a set policy. Market begins heading upwards and media tells us he's backing down.

July 17/18: Bernanke repeats that there are targets to get to. Not to assume it will happen or assume there is a set policy because it all depends on the data. Market hits new record high and media laud softening of his stance.

From where I'm sitting, nothing's changed in what's been said, only the media and investors have decided that he's changed his mind because of their tantrum.

Imagine a child wanting to go and play football with his Dad. "Dad, can we go and play football?". "Sure", the Dad says, "In an hour once I've finished mowing the lawn". The kid tantrums and screams to his father, "It's not fair, you won't play football with me". The father responds "Don't worry, I will play football with you, I just have to finish the lawn first". The kid starts to perk up "Can we play football now?", "Sure", says the Dad, "I'm nearly finished so we'll play shortly". The kid is now happy as he waits for his Dad to finish.

Sometimes you have to tell a child something a few times for them to understand what you said. You may need to slightly change the wording each time, just like the father above to get his child to understand. It's not that he won't get to play football, he just has to wait for the grass to be mowed first. That's a kid. A kid is growing, learning, needs simple things explained sometimes. Here we're talking about supposedly knowledgeable investors and media analysts. You might expect a kid to misunderstand a clear statement, to interpret it in a different way when it's first mentioned and then change his interpretation when the same thing's said again.

Bernanke repeated the same agenda 3 times in the last month. Nothing's changed, it seemed pretty clear first time round. Yet unfortunately there's a big kid out there who either doesn't listen or tries to only hear the bad side without listening to the good (or sensible) of what they're told first time around. So he's got to repeat himself in a different way so they understand. Do they understand, I'm still not convinced they do. The kid needs to learn quickly that there's a straight talking agenda and all they need to do is listen properly. That way the tantrum won't be necessary and they (and we) can breathe easier. I guess it's just all part of growing up in a new world.

|

| S&P 500 19th Jun-18th Jul (c) Bloomberg |

No comments:

Post a Comment